Program Duration

Duration 3 months

Training & Practice hours 75+

Program Pedalogy

Version 1 - Online, Self-paced

Version 2 - Online, Live training

Batch Starts

Version 1 - Self-paced

Version 2 - Batch starts Jan 15, 2022

Program Highlights

-

Industry-oriented curriculum

-

Applied learning on platforms

-

Industry recognized certifications

-

Learn Payment Technologies

-

Learn Cryptocurrencies

-

Learn P2P Lending

About Our Program

The Certification program” Payment, Crypto-currencies, & Alternative Finance” is being offered by Christ University, in collaboration with industry partners/collaborators such as EduEdge Pro, and Blockchain Council.

This Program is designed to provide deep rigorous training in Cryptocurrencies Primer, Importance of ICO in Alternative platform, Global Payment Ecosystem, Payment Stacks in India, Concept of P2P Lending, Crowdfunding Architecture, SME/MSME Lending, Regulatory Framework for Product Pricing, and other important frameworks

LEARN

CRYPTOCURRENCIES

You will learn different cryptocurrencies such as Bitcoin and Ethereum and their applications to the different Fintech areas and domains

You will learn digital wallets and mobile payments and also discover back-end innovations like tokenization, mobile money, and new payment infrastructure.

"

APPLIED HANDS-ON

LEARNING

You will gain hands-on experience in building Cryptocurrencies applications through platforms widely used in the industry.

AFFILIATED INDUSTRY-RECOGNIZED

DUAL CERTIFICATIONS

You will additionally earn certifications from Blockchain Council.

SKILLS YOU WILL LEARN

Algorithms, models and frameworks in Payment, Crypto-currencies, & Alternative Finance

Learn models, technologies and stacks relevant to FinTech

-

Fintech

-

crowdfunding

-

cryptocurrencies

-

crypto wallets

-

regulatory sandbox

-

leran P2P lending

-

digital forensics

-

Hyper Ledger

-

DigPaymentital

-

crypto tokens

-

Cyber Security

-

ICO's

PROGRAM OBJECTIVES

-

75+

TEACHING & PRACTICE HOURS

-

10+

CRYPTOCURRENCIES, ICOs AND TECHNOLOGIES

-

25+

PAYMENT TECHNOLOGIES, PAYMENT STACKS AND P2P LENDING MODELS

-

10+

LEARN FROM INDUSTRY LEADERS, DOMAIN PROFESSIONALS & ACADEMIC EXPERTS

-

24x7

ACCESS TO LEARNING MANAGEMENT SYSTEM WITH FULLY RECORDED VIDEOS

YOU WILL LEARN 5+ PLATFORMS AND TOOLS USED IN FINANCIAL ANALYSIS

Practical applied training in platforms commonly used in Financial Analyst roles

Participants can apply domain concepts and frameworks in such platforms

PAYMENT, CRYPTO-CURRENCIES, & ALTERNATIVE Finance PLATFORMS/TOOLS YOU WILL LEARN

Our Alumni at Work

WHAT JOB ROLES WILL I BE PREPARED FOR

- FinTech Analyst

- Data Engineer

- Payments Engineer

- Research Analyst

- Cryptocurrency Analyst

- Technical writer

- Developer

- Blockchain Analyst

- Crypto Analyst

- Product Manager

- Data Architect

- Business Analyst

SOME OF THE TOP COMPANIES THAT RECRUIT FOR PAYMENTS, CRYPTO-CURRENCIES & ALTERNATIVE FINANCE

FINANCIAL ANALYST

Avg Salary

Upto INR 15-20LPA Upto USD 100-150K per year

Work Experience

Upto 3-4 years

Skills

A Bachelor?s degree in Finance/Mathematics/Statistics/Economics/Accounting is usually the basic requirement Programming skills: Python, Excel-VBA

APP DEVELOPERS

Avg Salary

Upto INR 15-20LPA Upto USD 100-150K per year

Work Experience

Upto 6-7 years

Skills

Knowledge of Machine Learning, Artificial Intelligence (AI) and Deep Learning Programming languages:?C#, C++, Java, Python, JavaScript Analytical skills Understanding of databases

BLOCKCHAIN EXPERTS & DEVELOPERS

Avg Salary

Upto INR 25LPA Upto USD 150K per year

Work Experience

Upto 3-4 years

Skills

Programming languages:?C, C++, Java Other Programming skills:?Hyperledger Fabric, Ripple, Solidity (Ethereum)

PRODUCT MANAGER

Avg Salary

Upto INR 20-30LPA Upto USD 150-200K per year

Work Experience

Upto 7-10 years

Skills

Programming languages:?Basic Other skills:? Project Management, FinTech Technologies, Business understanding, Marketing

DATA SCIENTIST

Avg Salary

Upto INR 30-40LPA Upto USD 200-300K per year

Work Experience

Upto 7-10 years

Skills

Knowledge of Machine Learning, Artificial Intelligence (AI) and Deep Learning Data science toolkits:?R, Python, Weka, NumPy, MatLab Data visualisation tools:?D3.js, ggplot Proficiency in using?query languages:?SQL, Hive, Pig NoSQL databases:?MongoDB, Cassandra, HBase Applied statistics skills:?Distributions, statistical testing, regression analysis

Program Pathway & outline

1

CRYPTO-CURRENCIES AND ICOS

Learn the Cryptocurrencies with Crypto Commodities & Crypto Tokens, Creation of the first bitcoin domain, Cryptocurrencies and digital crypto wallets

2

PAYMENTS -ARCHITECTURE AND TECHNOLOGIES

Learn current payment system technologies to examine their strengths and weaknesses, and understand the ways technological innovation is changing these traditional systems.

3

P2P LENDING, CROWD-FUNDING AND INFRASTRUCTURE

Learn Peer-to-Peer (P2P) Lending and how it works, Popular peer to peer networks and platforms And Concept of Crowdfunding

Overview

-

Duration

25 hours

-

Includes

Comprehensive notes Practical examples Use cases on crypto token , wallet and ICO Relevant codes in Python

CRYPTOCURRENCIES PRIMER

- Cryptocurrencies

- Crypto Commodities

- Crypto Tokens

- The Bottom Line

- Cryptocurrencies compare to Traditional currencies or investments

- Buy and sell cryptocurrencies

- Benefits and considerations of transacting with cryptocurrencies

- Biggest risks associated with speculating in cryptocurrencies

BITCOIN AND APPLICATIONS

- Bitcoin ? Introduction

- How does Bitcoin handle double spending problem?

- Creation of the first bitcoin domain

- Bitcoin Transactions

- How does Bitcoin have value?

- How to send bitcoins?

- Anonymity of Bitcoin transactions

CRYPTOCURRENCIES AND DIGITAL CRYPTO WALLETS

- Wallet

- What are public and private keys??

- Types of Bitcoin Wallets

- Mobile, Desktop and Web Wallets

- Opening a Bitcoin Wallet Account

ICO

- What Is an ICO?

- Who Can Launch an ICO???

- How Do I Start My Own ICO?

- Marketing Your ICO

- What's With All These Celebrity ICOs?

- How Do I Determine Which ICOs Are Good?

- Going to Regulate ICOs

Overview

-

Duration

25 hours

-

Includes

Comprehensive notes Practical examples Use cases payment technologies in Indian markets Use cases payment technologies in international markets Relevant codes in Python

REGULATIONS FOR CRYPTO AND TOKENS

- Global Legal Insights, Blockchain & Cryptocurrency Regulation

- Legal Status of Cryptocurrencies on ContinentsDistributed ledger technology

- Regulation Steps for Cryptocurrency Trading Platforms

GLOBAL PAYMENT ECOSYSTEM

- Evolution of Payments

- The Basic Criteria That Drives Adoption

- How Will Payments be Different in the Future?

- ToneTag: A Perspective

PAYMENTS ARCHITECTURE AND SETUP

- Building a successful payments system

- Protocol

- Networks and schemes: What?s the difference?

- The outlook for incumbents

- Opportunities for new entrants

- Use case of SWAPEROO Architecture

POPULAR PAYMENTS TECHNOLOGY

- Credit Card Innovations

- Payment Technology in Emerging Markets

- PayTech in Developing Markets

- Business Model

Overview

-

Duration

20 hours

-

Includes

Comprehensive notes Practical examples Use cases payment technologies in Indian markets Use cases payment technologies in international markets Relevant codes in Python

PAYMENT STACKS IN INDIA

- What are Digital Payments

- What are the different methods of digital payments?

- What are the benefits of digital payments?

- Razorpay Payment Gateway: Your digital payment partner as a Use case.

- B2B & B2B2C solutions

- Innovative Products in Mobile based, Credit Cards, POS based ecosystem" "

Concept of P2P Lending

- What Is Peer-to-Peer (P2P) Lending?

- Understanding Peer-to-Peer Lending

- Special Considerations

- Advantages and disadvantages of peer-to-peer lending

P2P Infrastructure and technologies

- What is P2P (Peer-to-peer) technology?

- what is the client-server model?

- What is a peer in networking? How does P2P work?

- What is an example of a peer to peer network? what is P2P used for?

- Popular peer to peer networks and platforms

- Use case Napster

Concept of Crowdfunding

- How does crowdfunding work?

- How is Crowdfunding different?

- The Benefits of Crowdfunding:

- Examples of Crowdfunding

Investment for the Program

VERSION 1 SELF-PACED ONLINE

-

Financing Options

Certified Cryptocurrency Expert (CCE) From BlockChain Council (Training included)

-

When can you take

Take anytime, Self-paced

VERSION 2 LIVE TRAINING ONLINE

-

Financing Options

- a.

Certificate from Christ University

- b.

Certified Cryptocurrency Expert? (CCE) From BlockChain Council (Training & Examination costs included)

- a.

-

When can you take

Batch starts Jan 7, 2022

Frequently asked question's about the course

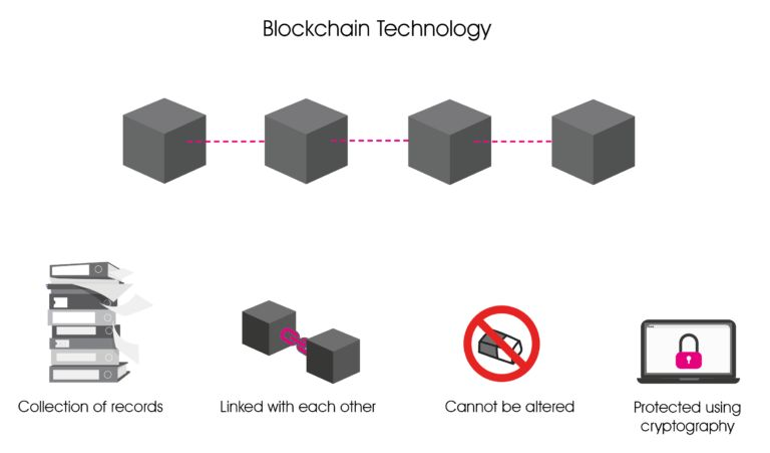

Cryptocurrency is a type of virtual currency that uses cryptography to secure transactions that are digitally recorded on a distributed ledger, such as a blockchain. A transaction involving cryptocurrency that is recorded on a distributed ledger is referred to as an on-chain transaction; a transaction that is not recorded on the distributed ledger is referred to as an off-chain transaction.

Cryptocurrencies, or cryptos, are forms of digital, decentralized money not regulated by a government or central bank. Instead, cryptos use encryption techniques to generate, regulate and transfer their units. Cryptocurrencies are often held in virtual online wallets and used for peer-to-peer transactions or online stores that accept them.

A cryptocurrency is a digital or virtual currency that is secured by cryptography, which makes it nearly impossible to counterfeit or double-spend. Many cryptocurrencies are decentralized networks based on blockchain technology a distributed ledger enforced by a disparate network of computers. A defining feature of cryptocurrencies is that they are generally not issued by any central authority, rendering them theoretically immune to government interference or manipulation.

""KEY HIGHLIGHTS

Bitcoin was the first decentralized cryptocurrency. Created in 2009, Bitcoin uses blockchain verification technology to secure and protect peer-to-peer transactions. Like other cryptocurrencies, Bitcoin is decentralized and not regulated by a central bank or any one government.

Ethereum is a popular open-source, decentralized cryptocurrency platform and operating system created in 2015 that uses blockchain technology for security. Ethereum or ether are both terms used when referring to the cryptocurrency generated by the Ethereum platform.

More than 10,000 different cryptocurrencies are traded publicly, according to CoinMarketCap.com, a market research website. And cryptocurrencies continue to proliferate, raising money through initial coin offerings, or ICOs. The total value of all cryptocurrencies on Aug. 18, 2021, was more than $1.9 trillion down from April high of $2.2 trillion, according to CoinMarketCap. The total value of all bitcoins, the most popular digital currency, was pegged at about $849 billion, regaining some ground from recent price lows. Still, the market value of bitcoin is down from April high of $1.2 trillion.

These are the 10 largest trading cryptocurrencies by market capitalization as tracked by CoinMarketCap, a cryptocurrency data and analytics provider. Data current as of Oct. 1, 2021.

Cryptocurrencies appeal to their supporters for a variety of reasons. Here are some of the most popular:

Blockchains are designed to use cryptocurrencies as the "ink" for writing records on the blockchain. Cryptocurrencies are therefore different from blockchain, but, yet, an integral part of blockchain technology. We explain in the course on how a privately-run blockchain may not use cryptocurrencies, but such use of privately-run blockchains is very limiting and expensive.

CRYPTO TOKENS

Tokenization of Precious Metals

The use cases of tokenization for precious metals such as gold are rightly valid on the grounds of the comparatively illiquid nature of the market for precious metals.

DIGITAL WALLET

Mobile, Desktop and Web Wallets

Create crypto wallets for Linux, Mac, and Windows in various ways of Mobile App, Desktop and Web.

P2P NETWORK

Infrastructure for Social Networks

Use case of online Social Networks like Facebook, MySpace, Xing, etc. have become extremely popular.

PAYMENTS ARCHITECTURE

Payment Technology

Use SWAPEROO architecture, the interaction between a client wallet and a peer wallet

Product Manager

The product manager will design, architect, and develop a decentralized blockchain network that allows strong data security, strong control of data, easy integration, creation of new profit centers and reduction of cost.

Blockchain Expert

Blockchain has emerged a great FinTech technology with immense applications across BFSI. This growth will greatly increase the need for blockchain experts, such as blockchain developers

Blockchain Developer

The demand for mobile payment solutions and personal finance is only growing, as it is being driven by an appetite from younger generations of tech-savvy consumers. There will be a stronger need in future years for financial technology app developers to serve this booming market.

Cybersecurity Analyst

Online thieves and hackers always go where the money is. A report by Cybersecurity Ventures recently estimated that cyber crimes will be triple the number of job openings in the next five years. There also will be at least 3.5 million unfilled cybersecurity positions by 2021..

Compliance Expert

As the regulatory burden in FINTECH grows, there will be more compliance experts, compliance officers, and compliance analysts working in these financial companies

FinTech Analyst

Financial analyst jobs in FINTECH are in great demand as domain expertise in various financial domains is needed to understand and then apply technology upon.

Compliance Expert

As the regulatory burden in FINTECH grows, there will be more compliance experts, compliance officers, and compliance analysts working in these financial companies.

VERSION 1 SELF-PACED ONLINE

When can you take

Take anytime, Self-paced

Certification included

Certified Cryptocurrency Expert (CCE) From BlockChain Council (Training included)

VERSION 2 LIVE TRAINING ONLINE

When can you take

Batch starts Jan 7, 2022

Certification included

A Certificate from Christ University

B Certified Cryptocurrency Expert (CCE) From BlockChain Council(Training & Examination costs included)

Peer networking

In addition to the training program, you will have ample opportunity to network with the peers in your cohort. Prior to coming to the program, you will have access to your cohort where you can meet and engage with your peers before, during, and after the program.

Industry networking

Throughout the program, you will be taught and mentored by Industry experts from the Equity Research industry and working/having worked with leading Investment banks, Brokerage firms, Consulting firms and Fund houses.

Alumni networking

Besides, after the program, you will be invited to join the Capital Markets Alumni group.

Placement Leads

We have networks with leading industry participants including FinTech companies, banks, financial institutions, consulting firms and analytics firms; you can leverage that network for connecting with the industry and finding suitable opportunities in Fintech. Once you are trained and ready, we will help you with placement leads that can help you land your dream role in FinTech.

Having said that, its entirely your performance and skill-sets that will define your journey in landing your dream job. We cannot guarantee that you will get a job after completing the program. Obtaining a job is strictly based off one s own skill sets. Upon completion of the program, we will provide you with a certificate that you can print and/or add to your LinkedIn profile.

Networking opportunities

You will have great networking opportunities at the program. Our industry faculty work in the industry in leading positions and that will provide a great opportunity for you to network. Besides, EduEdgePro, through its vast industry network, will help you reach out to the leading firms for placements..

Yes, this is an online program.

There are 2 versions