Program Duration

Duration – 11 months Training & Practice hours – 300+

Program Pedagogy

Online, Part-time Classroom intervention – once in 6 weeks

Batch Starts

Jan 15, 2022

Program Highlights

-

Industry-oriented

-

Applied learning on platforms

-

Industry recognized Certifications

-

Capston Project

-

Financial Modelling with Excel & Bloomberg

About Our Program

The Post Graduate Diploma Program in Investment Banking and Global Market is being offered by Christ University, in collaboration with industry partners and collaborators such as EduEdge Pro, Moody’s Analytics, CMT Association, CFA Institute and AIWMI - Association of International Wealth Management of India.

This Program is designed to provide deep rigorous training in Fundamental Analysis & Applied Equity Research, Technical & Global Intermarket Analysis , Risk Management & Treasury, and Investment Banking including Prospectus & Pitchbook creation for the participants looking to upgrade themselves in the Investment Banking and Global Markets arena.

POST GRADUATE DIPLOMA

CERTIFICATE

You will earn the prestigious degree from Christ University

APPLIED HANDS-ON

LEARNING

You will gain hands-on experience in learning and applying the Financial Analysis knowledge required to be successful in Investment Banking

AFFILIATED INDUSTRY-RECOGNIZED

DUAL CERTIFICATIONS

You will additionally earn certifications from Acuity (formerly Moody?s Analytics), CMT Association, CFA Institute, AIWMI and IIBF

DEDICATED ASSISTANCE

PLACEMENTS

You will be provided 100% Placement assistance once you undergo our program

SKILLS YOU WILL LEARN

Investment Banking, Global Markets, Treasury, Equity Research, Trading and Risk

Learn practical concepts and industry applications across above domains

-

Asset Classes

-

Global Markets

-

Equity Research

-

Asset Classes and Business Cycles

-

ValuSpreadsheetingation

-

Treasury

-

Risk Regulations

-

IPOs, QIP and FPOs process

-

Inter-market Analysis

-

Fundamental Analysis

-

Portfolio Construction

-

Portfolio Modelling

-

Financial Analytics

-

Risk Management and Framework

-

Investment Banking Framework

-

Smart Factor Portfolios

PROGRAM OBJECTIVES

-

450+

TEACHING & PRACTICE HOURS

-

300+

LEARNING HOURS

-

7+

INVESTMENT BANKING AND GLOBAL MARKETS APPLICATIONS/TOOLS YOU WILL LEARN

-

25+

LEARN FROM INDUSTRY LEADERS, DOMAIN PROFESSIONALS & ACADEMIC EXPERTS

-

50+

PERSONAL MENTORING HOURS FOR INDUSTRY READINESS

-

24x7

ACCESS TO LEARNING MANAGEMENT SYSTEM WITH FULLY RECORDED VIDEOS

YOU WILL LEARN 7+ PLATFORMS AND TOOLS USED IN INVESTMENT BANKING

Practical applied training in platforms commonly used in the Investment Banking industry

Participants can apply domain concepts and frameworks in such platforms

Financial analysis & modelling - Platforms/Tools You Will Learn

Our Alumni at Work

WHAT JOB ROLES WILL I BE PREPARED FOR

- Investment Banking Analyst

- Financial Analyst

- Equity Research Analyst

- Fundamental Analyst

- Technical Analyst

- Global Markets Analyst

- Risk Analyst

- Treasury Manager

- Banking Analyst

- Portfolio Analyst

- Portfolio Manager

- Trading Analyst

SOME OF THE TOP INVESTMENT BANKING GLOBALLY THAT RECRUIT FOR FINANCIAL ANALYST ROLES

CAREER PATH IN INVESTMENT BANKING & REWARDING COMPENSATIONS

ANALYST / SENIOR ANALYST

Avg Salary

3-12LPA

Work Experience

0-4 years

Skills

Impeccable research Quantitative skills Analytical skills Understand markets Valuation Financial Modelling Spreadsheet expert Good with presentations Report writing skills Data Visualizations

ASSOCIATE / SENIOR ASOCIATE

Avg Salary

12-25LPA

Work Experience

4-8 years

Skills

Impeccable research Quantitative skills Analytical skills Understand markets Valuation Financial Modelling Spreadsheet expert Good with presentations Report writing skills Data Visualizations

VICE PRESIDENT

Avg Salary

25-75LPA

Work Experience

8-12 years

Skills

Impeccable research Analytical skills Understand markets Valuation Spreadsheet expert Good with presentations Report writing skills Understand regulations

SENIOR VP

Avg Salary

75-150LPA

Work Experience

12-18 years

Skills

Deal structuring Good with presentations Report writing skills Understand regulations Management skills Project Management skills

MANAGING DIRECTOR

Avg Salary

150LPA+

Work Experience

18 years +

Skills

Deal structuring Good with presentations Report writing skills Understand regulations Leadership skills Project Management skills

Program Pathway & outline

1

FUNDAMENTAL ANALYSIS AND APPLIED EQUITY RESEARCH

Learn how to perform Fundamental Analysis, Valuation and write Equity Research report

2

TECHNICAL ANALYSIS AND GLOBAL INTER-MARKET ANALYSIS

Learn Technical Analysis and inter-market analysis amongst asset classes to predict market trends

3

APPLIED GLOBAL MARKETS - RISK MANAGEMENT AND TREASURY

Learn Treasury Management & Hedging and learn applied Risk Management & Modelling

4

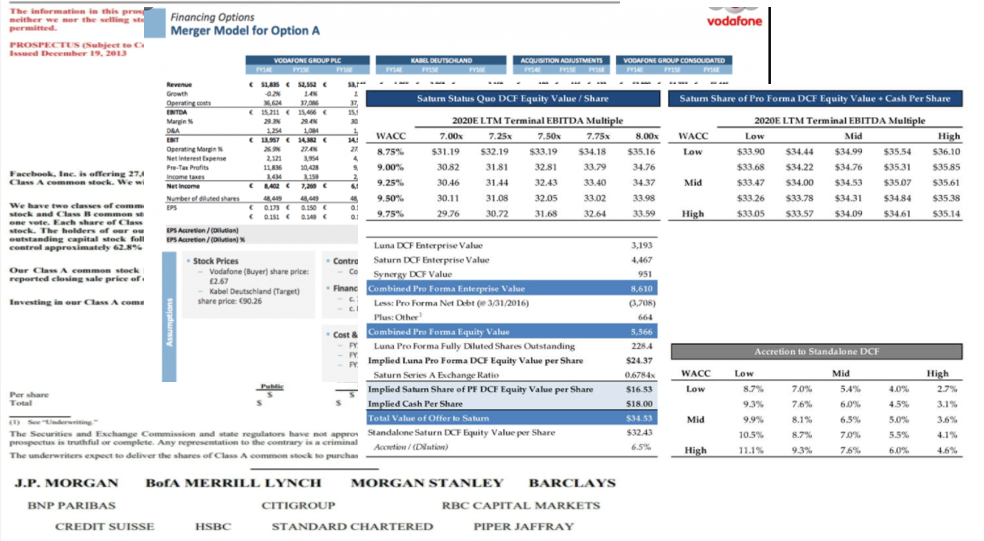

INVESTMENT BANKING AND CAPITAL RAISING

Understand the entire Underwriting & Corporate Advisory process. Learn to make professional Investment Banking pitch-books

Overview

-

Duration

75 hours

-

Includes

Comprehensive notes Practical examples Solved excel examples Excel templates Bloomberg templates

-

Certification

Certified Financial Analysis and Equity Research Analyst

Platform you will learn

Fundamental Analysis

Equity Research

Report Writing

Valuation Spreadsheeting

Fundamental Analysis Essentials

- Financial Statements Analysis

- Ratio Analysis

- Macroeconomic Analysis

- Macroeconomics & Business Cycles

- Time Value concepts

- How to analyze fundamentally good companies

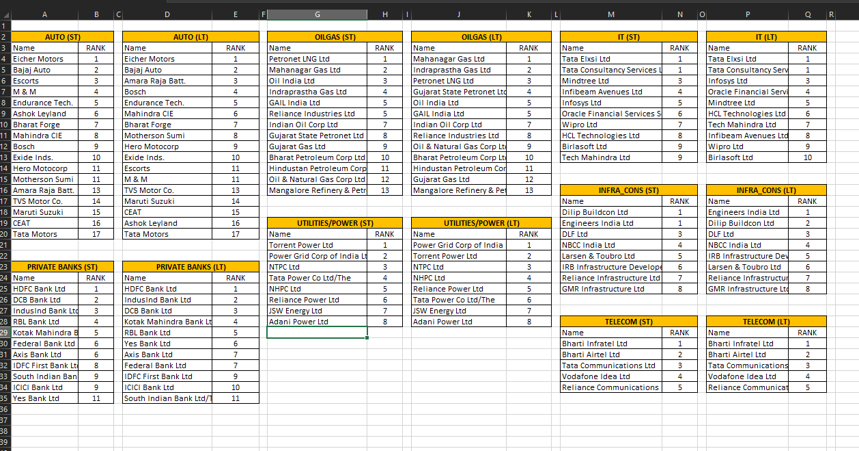

- Building Fundamental Factor models to score and rank stocks in a sector

DISCOUNT BROKING

- Cryptocurrencies Primer

- Bitcoin and Applications

- Cryptocurrencies and Digital Crypto Wallets

- Types of Cryptocurrencies

- Cryptocurrencies and Applications

- What is an ICO?

- Importance of ICO in Alternative Finance

- Regulations for Cryptos and tokens

Industry & Company Analysis

- Industry Analysis Frameworks

- Industry Risk Assessment

- Company Analysis

- Cash Flow Analysis

ALGORITHMIC TRADING

- Architecture of Algorithmic Trading

- Lifecycle of Algorithmic Trading

- Risk, Costs and Roles in Algorithmic Trading

- Conceptualization and Backtesting Strategies

- Business aspects of FinTech in Capital Markets

- Fund Management and Algorithmic Trading

- Setting up an Algo bot

Valuation Essentials

- Cost of Capital & WACC

- Optimal Debt Structure

- Free Cash Flows & projections

- DCF Valuation framework

- Terminal Value

ROBO-ADVISORY AND APPLICATIONS

- Robo Advisory

- Automating Investment rules

- ML/AI in Robo-advisory

- Robo-advisory Platforms and Architecture

- Building a Robo Advisory Platform

- Unicorns of Robo-advisory and business models

- State of Robo-advisory in India

Valuation Models

- DCF based ? DDM, FCFF & FCFE

- Multiples based Valuation

- Valuations using real Options

- Valuing Start-ups

- Valuing Distressed companies

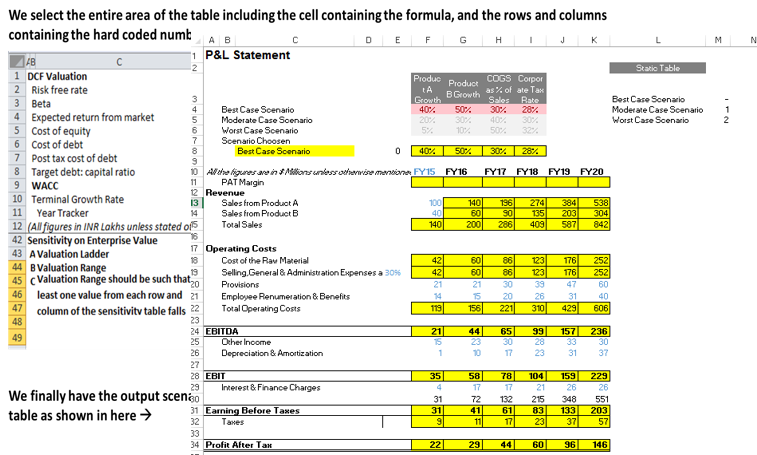

Building Integrated Financial models

- Creating a financial model template

- Understanding Growth Drivers

- Assumptions for Modelling

- Revenues Build-up

- Costs Build-up

- Cash Flow Projections

- Valuation Modelling

- Scenario Analysis

Understanding Bloomberg

- Logging into Bloomberg

- The Bloomberg Keyboard

- Helpful Keys

- Accessing The Application

- Logging In

- Bloomberg Panels

- General navigation

- Important Bloomberg Functions

Working with Market Data

- The Bloomberg Excel Add-In

- Important functions for data

- orting data from Bloomberg

- Printing & Other Export Options

- Navigating Functions

- Stock/Company Screening

- Analyzing a Company

Overview

-

Duration

75 hours

-

Includes

Comprehensive notes Practical examples Bloomberg templates

-

Certification

Chartered Market Technicians (CMT) Level 1

Platform you will learn

Technical Analysis

Inter-market Analysis

Global Markets

Business Cycles & Macroeconomics

Asset Classes

Essentials of Technical Analysis

- Identification of trends

- Breakouts, Stops & Retracements

- Reversal & Continuation Patterns

- Fibonacci based Retracement

- Elliot Waves & Trading strategies

- Directional Momentum Strategies

- Oscillators & Trading Strategies

Advanced Technical Analysis

- Applying Technical Analysis over different classes

- Implementing Technical Analysis over Futures

- Option Trading strategies with Technical Analysis

- Risk Management using Technical Analysis

- Position Sizing and Laddering

- Integrated Trading Plan

Intermarket Analysis

- Learn behavior of different asset classes

- Macroeconomics and business cycles

- Business cycles and asset class movements

- How are Equity and debt markets interlinked

- How are Commodity and FX markets related

- Inter-market sectoral rotation

Institutional Trading Strategies

- Quantitative Trading strategies

- Price Action strategies

- Statistical Arbitrage strategies

- Index Replication strategies

- Options Trading strategies

- Volatility Trading strategies

Algorithmic Trading

- Introduction

- Evolution of Algorithmic Trading

- Algorithmic Trading Styles

- Lifecycle of Algorithmic Trading

- Algorithmic Trading Architecture

- Market Microstructure

- Backtesting & Optimization

Overview

-

Duration

75 hours

-

Includes

Comprehensive notes Practical examples Solved excel examples Excel templates Bloomberg templates

-

Certification

Certificate Program on Advanced Treasury and Foreign Exchange Risk Management

Platform you will learn

Treasury

Risk Management and Framework

Risk Regulations

Risk Modelling and Spreadsheeting

Treasury Management

- Structure of Treasury department

- Treasury Operations

- Managing Liquidity

- Asset Liability Management

- Balance Sheet Management

- Risk Capital & Requirements

Money Market Operations

- CRR & SLR

- Money Market overview

- Managing banks' surplus funds

- Overnight Call Money Market

- Repos & Reverse Repos

- Money Market instruments

- Benchmarks

Hedging

- Structuring for hedging

- FX Hedging & structures

- Rates Hedging & structures

- Hedging INR Floating-rate Liability

- Hedging USD Floating-rate Liability

- Cross Asset Hedging

Essentials of Risk Management

- Types of Risks

- Economic & Regulatory Capital

- Concept of RWA

- Overview of Basel 2, 2.5 and 3

- RWA and Capital Adequacy

- Important Risk Measures

- Introduction to Value-at-Risk

- Expected/Unexpected Loss

Value-at-Risk and Market Risk

- Historical Simulation

- Monte Carlo Methods

- Delta Normal VaR

- Stress Testing

- Portfolio VaR

- Market Risk under Basel 2.5

Credit and Operational Risk

- Measuring Credit Risk

- Regulatory Capital for Credit Risk

- Credit VaR

- Counterparty Credit Risk

- Credit Risk Mitigation

- Operational Risk and Measurement

Overview

-

Duration

75 hours

-

Includes

Comprehensive notes Practical examples Solved excel examples Excel templates Bloomberg templates

-

Certification

Certificate Program on Advanced Treasury and Foreign Exchange Risk Management

Platform you will learn

Investment Banking Framework

IPOs, QIP and FPOs process

Investment Banking Prospectus and Pitchbook

Industry Structure

- Investment Banking industry

- Sell side activities

- Buy side activities

- Functions in Investment Banking

Essentials of Investment Banking

- Primary and secondary markets

- IPOs, FPOs & QIP

- Mergers & Acquisitions

- Leveraged Buyouts

- Red Herring Prospectus

- Pitch Process

Domains in Investment Banking

- Investment Banking Division

- Equity Research

- Treasury - Sales & Trading

- Equity Capital Markets

- Debt Capital Markets

- Credit Analysis

- Venture Capital

- Private Equity

- Hedge Funds

Capital Raising & Underwriting

- Capital raising methods

- Pre-issue Management

- Post-issue Management

- Specifics of IPOs

- Specifics of QIP

- Specifics of FPOs

- Pricing methods for underwriting

- Determination of Price band

- SEBI guidelines (regulatory aspect)

- Draft Red Herring Prospectus

- Investment Banking Prospectus

- Use cases from the industry

Leveraged Buyouts

- Key Participants

- Characteristics of LBO Canidate

- Economies of LBOs

- Primary Exit/ Monetization Strategies

- LBO Financing: Selected Key Terms

- Building the Pre-LBO Model

- Input Transaction Structure

- PerCompleting the Post-LBO Model

- forming LBO Analysis

Deal Pitchbook

- Industry Landscaping

- Data on Buyers & Sponsors

- Transaction Section

- Illustrating Modelling results

- Illustrating Scenarios

- Writing Recommendation section

Main Pitchbook

- Organization details

- Presence & key personnel

- Track Record presentation

- Firm's ranking vs peers

- Recent Deals

- Successful Investments

- Market Overview

- Current Trends

Practicle Learning Through The Capstone Project

WHAT IS IT ?

The Capstone Project gives you the opportunity to apply what you've learned about how to make data-driven decisions to a real business challenge faced by businesses.

OBJECTIVES

At the end of this Capstone, you'll be able to apply Investment Banking ? Prospectus and Pitch-book, Equity Research, Valuation Modelling and Report Writing, Financial Modelling, Spreadsheeting and Scenario Analysis, Equity Research ? Ratio Dashboarding, Fundamental Analysis ? Fundamental Factor Models, Technical Analysis and Inter-market analysis; Learn how to back-test trading ideas, Risk Management and Modelling

KEY HIGHLIGHTS

- Live Project

- Designed With leading I-banks

- Work With An Industry Mentor

- Choose Domain Of Choice

- Inter-disciplinary

- Project Guidance

- Hand-holding

- Data Support

- Domain Expertise Support

- 2-month Duration

INDUSTRY CONNECT

Designed with Investment Banking companies to give you invaluable experience in evaluating and creating Investment business models, the Capstone Project provides the chance for you to devise a plan of action for Equity Research, Fundamental and Technical and Inter- Market Analysis.

Put Financial Analysis and Modelling to practice

-

Fundamental Analysis

-

Equity Research & Report Writing

-

Valuation Spreadsheeting

-

Risk Modelling & Spreadsheeting

-

Technical Analysis

-

Inter-market Analysis

-

Investment Banking Prospectus & Pitchbook

-

Treasury ? Asset Liability Management

Capstone Project examples

Writing an Investment Banking ? Prospectus and Pitch-book

Preparing an end-to-end Equity Research report including Valuation scenarios and Thematics

Create an end-to-end integrated Valuation model to value any company. Run Scenario Analysis and Monte Carlo Simulations

Create Fundamental Factor models to score and rank companies in every sector

Admission Process

-

PROGRAM COUNSELLING

We have a dedicated admission counsellor who are here to help guide you in applying to the program. They are available to:

- Address questions related to application.

- Assist with Financial Aid (if Required)

- Guide career role and opportunities after certified.

- Help you to understand the program detail and pedagogy.

-

APPLICATION PROCESS

- Complete your application to kick start the admission process.

- Rate your various skills of OOPs language, quantitative and logical ability.

- Submit application fee: ? 500/-

- Submit the form successfully and scheduled your interview with us.

-

INTERVIEW PROCESS

- Interview is with admission committee, who will review the candidate profile.

- Selection will be determined on the basis of academic records, work experience, test scores and interview.

- Upon qualifying a confirmation letter for admission to the PG Diploma in Data Science will handover to the candidate.

-

Documentation

After interview on the basis of confirmation letter , the required papers mentioned in the mandatory list of documents as per eligibility criteria. You would be required to submit your marksheets, education certificates, work experience proofs amongst other necessary documents.

-

Payment Processing

Block your seat with the initial amount of fees and begin with your prep course and start your Data Science journey.

Full or annual program fee to be deposited within 1 week of offer letter / program start ? whichever is earlier.

-

Confirmation

Your admission will be confirmed basis the selection procedure, document authentication and fee payment.

A welcome letter, ID card, student number and portal access will be shared upon successful completion of the admission process.

Investment for the Program

Full Program Fees

-

Scholarships

Existing Christ students and Alumnus: Available Other participants: Available on outstanding merit record

-

Financing Options

0% Interest EMI option available with partner banks Easy procedure with partner banks EMI as low as INR 14,000 per month

-

Corporate Discounts

Available on nominations of 2+ participants Kindly contact us for further details

Individual Program Fees

Frequently asked question's about the course

Investment Banking:

Investment banking is a special segment of banking operation that helps individuals or organisations raise capital and provide financial consultancy services to them.

They act as intermediaries between security issuers and investors and help new firms to go public. They either buy all the available shares at a price estimated by their experts and resell them to public or sell shares on behalf of the issuer and take commission on each share.

Investment banking is among the most complex financial mechanisms in the world. They serve many different purposes and business entities. They provide various types of financial services, such as proprietary trading or trading securities for their own accounts, mergers and acquisitions advisory which involves helping organisations in M&As,; leveraged finance that involves lending money to firms to purchase assets and settle acquisitions, restructuring that involves improving structures of companies to make a business more efficient and help it make maximum profit, and new issues or IPOs, where these banks help new firms go public.

Sell side:

Sell-side (Investment Banking) helps companies/governments raise capital by selling securities to Buy-side (Asset Management)

A banks markets division, also known as its Treasury, is part of its wholesale banking business. It is a highly specialized area that seeks to meet institutional and corporate customers investment and risk coverage needs.

Underwriting:

Capital raising and underwriting groups work between investors and companies that want to raise money or go public via theIPO process. This function serves the primary market or new capital

Capital raising and underwriting groups work between investors and companies that want to raise money or go public via theIPO process. This function serves the primary market or new capital

Mergers & Acquisitions (M&A):

Advisory roles for both buyers and sellers of businesses, managing theM&A processstart to finish.

Sales & Trading:

Matching up buyers and sellers of securities in the secondary market.Sales and trading groupsin investment banking act as agents for clients and also can trade the firms own capital.

Equity Research:

Theequity research groupresearch, or coverage, of securities helps investors make investment decisions and supports trading of stocks.

Asset Management:

Managing investments for a wide range of investors includinginstitutionsand individuals, across a wide range of investment styles

Work activities:

Investment Banking Analysts are typically recent college graduates or individuals who may have some financial industry work experience, but who are new to investment banking.

Analysts (and later associates) generally split the grunt work of investment banking doing basic research and producing endless reports that are typically sent back down by vice presidents or directors for endless revisions. They are also responsible for putting together what are called pitch books .

An investment banking pitch book is pretty much what it sounds like; a book (i.e., lengthy report or presentation) designed to pitch the bank s services to new or existing clients. Pitch books are used by directors or managing directors as handy reference guides and visual aids when making sales pitches to clients.

For example, a pitch book for a proposed IPO basically attempts to lay out how the bank will help the company considering the IPO to realize more money than it could ever have imagined possible. To buttress the bank s argument, a pitch book will often recount how successfully it handled the IPO of a similar company. However, just to cover its bases and avoid unrealistic expectations, the pitch book will also present numerous scenarios of various possible outcomes for the IPO, courtesy of numerous projections run by analysts or associates.

An analyst s day is typically occupied with doing research and writing reports. Investment banking analysts usually become world-class experts at generating spreadsheets in Excel. They are also often responsible for handling their supervisors schedules and fielding phone calls from clients.

In addition, analysts also generate solid discounted cash flow (DCF) valuations of companies, arrange meetings with clients, price new offerings, and produce (with the help of analysts doing all the hard work) weekly newsletters.

Typical day in the life of an Investment Banking Analyst:

Each day in your life as an Investment Banking Analyst is different, but an average day might look like this:

9 AM 12 PM: Arrive at the office, update a status report on potential buyers in an M&A deal, send it out, and join an update call with the client s management team. The senior bankers do most of the talking, so you work on a pitch book for a different, potential deal in the background.

12 PM 3 PM: You join a few due diligence calls for another deal, where the potential buyer asks customers of the seller questions about why they use its products and services. You re just there to monitor the calls and make sure the potential buyer doesn t go too far with its questioning. After that, you run to Starbucks with a few Analysts for a quick break.

3 PM 5 PM: There s a huge incident as a traveling Managing Director requests briefing materials for an upcoming pitch ASAP, and you have to scramble around to find and send hundreds of pages of reading.

5 PM 7 PM: Your Associate comes over to review the Confidential Information Memorandum (CIM) for the client from this morning, and you start making his changes to the financial summary and market sections.

7 PM 10 PM: As one of the VPs is leaving the office, he decides that the team needs to re-do a pitch book for an upcoming initial public offering (IPO), and he wants to see the new draft by tomorrow morning.

You start coordinating with the Equity Capital Markets (ECM) team to get market updates and case studies.

10 PM 1 AM: The Associate signs off on the new qualitative slides in this draft of the pitch book, and he leaves the office. You continue to tweak the valuation and Excel-based parts.

1 AM 2 AM: Another Analyst at the office is having a major problem with a complicated Excel model not working, so you decide to stay another hour to help out, and then you go home.

Factors that create bad days include:

Multiple Live Deals: If you re on 3-4 deals that are all active at the same time, the workload is unpredictable, and you could get streams of requests throughout the day.

Big Upcoming Pitches: Since pitches have hard deadlines and bankers like to do unnecessary work, you could easily end up staying late or even pulling an all-nighter to finish a long and detailed pitch book.

Last-Minute Emergencies: For example, if a traveling MD suddenly needs information for a meeting taking place in 1-2 hours, be prepared to scramble.

There are no pre-requisite qualifications for the course. We will be sharing pre-program content and videos that you can go through to help you better prepare for the program.

Participants from varied backgrounds such as Commerce, Management, Statistics, Finance, Financial Markets and other related fields will do well in the program. We require our participants to have a Graduate degree with minimum 50% pass percentage.

This program is carefully designed and curated for anyone who wants to improve his/her understanding of Investment Banking and Global Markets and those who want to become an Investment Banking Analyst.

This course is aimed at those with a solid financial background who wish to explore the advanced aspects of Investment Banking and Global Markets, financial modelling and valuation methodologies, including:

I-banking work requires a lot of financial modelling, valuation and domain knowledge. Whether for underwriting or M&A activities or Global markets roles, Analysts and Associates at banks spend a lot of time in Excel, building financial models, understanding markets and using various valuation methods to advise their clients and complete deals.

Investment banking roles require the following skills:

Financial modeling Performing a wide range of financial modeling activities such as building 3-statement models, discounted cash flow (DCF) models, LBO models, and other types of financial models.

Business valuation Using a wide range of valuation methods such as comparable company analysis, precedent transactions, and DCF analysis. Pitchbooks and presentations Building pitchbooks and PPT presentations from scratch to pitch ideas to prospective clients and win new business.

Transaction documents Preparing documents such as a confidential information memorandum (CIM), investment teaser, term sheet, confidentiality agreement, building a data room, and much more.

Relationship management Working with existing clients to successfully close a deal and make sure clients are happy with the service being provided.

Sales and business development Constantly meeting with prospective clients to pitch them ideas, offer them support in their work, and provide value-added advice that will ultimately win new business.

Negotiation Being a major factor in the negotiation tactics between buyers and sellers in a transaction and helping clients maximize value creation.

Global Markets roles require the following skills:

Knowledge of Global Markets

Fundamental analysis and Accounting

Financial Modelling, Valuation and Excel skills

Report Writing skills

Global Markets analysts work for both buy-side and sell-side firms in the securities industry producing thematic and company specific research reports, projections, and recommendations surrounding companies and stocks.

Yes, this is an online program.

Apart from video lectures, we will be conducting live sessions to help you understand and practice key concepts in Investment Banking and Global Markets.

Online mode

The classes would be majorly delivered in an online mode.

Classroom intervention

However, there would be classroom interventions, in the middle and towards the end of the program where you will have an opportunity to learn first-hand from industry experts in Investment Banking and Global Markets.

Hosting of learning content on LMS

All training sessions would be recorded and hosted on our LMS. Thus, even if you miss a synchronous class, you can always access the recorded session and catch-up.

Teaching Hours

Besides, there will be additional 2 hours of Teaching Hours every week, where you will get an opportunity to get your doubts cleared and seek clarifications on domain concepts.

All training sessions would be recorded and hosted on our LMS. Thus, even if you miss a synchronous class, you can always access the recorded session and catch-up.

Certified Financial Analysis and Equity Research Analyst

You will learn advanced concepts related to Financial Analysis, Equity Research and Report Writing from an industry perspective.

Moody's Analytics Knowledge Services Research (India) Private Limited (MA Knowledge Services, a subsidiary of Moody's Corporation) are taking proactive steps to prepare competent professionals for skills required for investment banking and research in India. MAKS has been rebranded as Acuity Knowledge Partners in India.

Chartered Market Technicians (CMT) Level 1

CMT Level 1 is a global benchmark in Technical Analysis and Global Inter-market Analysis taken by analysts worldwide.

The CMT Associationis the leading provider of technical analysis education and networking centered around price behavior and market statistics.

Certificate Program on Advanced Treasury and Foreign Exchange Risk Management

You will learn advanced concepts on Risk and Treasury through the program.

The Indian Institute of Banking & Finance (IIBF), formerly known as The Indian Institute of Bankers (IIB), is a professional body of Banks, Financial Institutions, and their employees in India. It is a premier Institute for developing and nurturing competent professionals in banking and finance field.

CFA Institute Investment Foundations Program

The CFA Institute Investment Foundations Program covers the essentials of finance, ethics, and investment roles, providing a clear understanding of the global investment industry.

This online learning experience is designed for institutions, including regulators and universities who have staff or students who wish to enter, advance in, or understand the Investment industry.

Certificate In Investment Banking (CIIB)

The Certified in Investment Banking (CIIB) certification is a comprehensive global certification exam designed to assess a candidate's expert level understanding of investment banking skills.

The Association of International Wealth Management of India (AIWMI) primarily focuses on the broad and strategic role of developing a more robust System.

Peer networking

In addition to the training program, you will have ample opportunity to network with the peers in your cohort. Prior to coming to the program, you will have access to your cohort where you can meet and engage with your peers before, during, and after the program.

Industry networking

Throughout the program, you will be taught and mentored by Industry experts from the Investment Banking and Global Markets world and working/having worked with leading Investment banks, Brokerage firms, Consulting firms and Fund houses.

Alumni networking

Besides, after the program, you will be invited to join the Capital Markets Alumni group.

Placement Leads

We have networks with leading industry participants such as investment banks, commercial banks, brokerage firms, financial institutions and funds; and you can leverage that network for connecting with the industry and finding suitable opportunities in Investment Banking and Global Markets. Once you are trained and ready, we will help you with placement leads that can help you land your dream role in Investment Banking and Global Markets.

Having said that, its entirely your performance and skill-sets that will define your journey in landing your dream job. We cannot guarantee that you will get a job after completing the program. Obtaining a job is strictly based off one s own skill sets. Upon completion of the program, we will provide you with a certificate that you can print and/or add to your LinkedIn profile.

Networking opportunities

You will have great networking opportunities at the program. Our industry faculty work in the industry in leading positions and that will provide a great opportunity for you to network. Besides, EduEdgePro, through its vast industry network, will help you reach out to the leading financial firms for placements.